unemployment tax forgiveness pa

A request for waiver is available for non-fraud overpayments of benefits for Pandemic Unemployment Assistance PUA Pandemic Emergency Unemployment Compensation. Register for a UC Tax Account Number.

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

The 19 trillion American Rescue Plan signed into law last week includes a welcome tax break for unemployed workers.

. Submit Amend View and Print Quarterly Tax Reports. Report the Acquisition of a Business. A penalty week is a week when you are unemployed and otherwise eligible to receive UC but benefits are denied because of past fraud.

Ad See the Top 10 Tax Forgiveness. We recommend waiting to file your taxes until after the Internal Revenue Service IRS has issued more guidance about how to get the tax forgiveness for up to 10200 in unemployment. Roughly 40 million people got benefits that year.

Over 50 Million Returns Filed 48 Star Rating Claim all the credits and deductions. Which table do I use. File and Pay Quarterly Wage.

1-800-829-1040Taxpayers eligible for PA Tax Forgiveness may also. Ad File unemployment tax return. You may be charged a penalty equal to 15 of the.

Get Information About Starting a Business in PA. Register to Do Business in PA. Ad Discover A Variety Of Information About Tax Relief Companies.

President Joe Biden signed a 19 trillion Covid relief bill Thursday that waives federal tax on up to 10200 of unemployment benefits an individual received in 2020. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020.

Make an Online Payment. If you live in PA and open a non-PA ABLE account you may miss out on important benefits. The wage base recently has been.

Then move across the line to find your eligibility income. Under the new law taxpayers who earned less than 150000 in modified adjusted gross income can exclude some unemployment compensation from their income. Tax rate increased 05 to 10 percentage point will be eligible for deferral only Tax rate increased more than 10 percentage point and not more than 15 percentage points will be eligible for 50.

And the Pennsylvania Unemployment Compensation Law. My spouse and I are separated. Ad PA residents who save in PA ABLE get benefits that other states ABLE plans cant provide.

The law waives federal income taxes on up to. The 15200 excluded from income. The Pennsylvania Tax Forgiveness Credit helps eligible PA taxpayers reduce their tax liability.

At the bottom of each column is an amount expressed as a decimal which represents the percentage of tax. In addition because many of the procedural rules for individuals filing for regular unemployment compensation also apply to. This form will soon be viewable on the online system.

Ad Our Licensed CPAs Attorneys IRS Enrolled Agents Are Here to Help You Achieve Tax Relief. Unemployment rate to spike to its highest level since the Great Depression. Get Instant Recommendations Trusted Reviews.

Real Tax Solutions For Real People. In Part D calculate the amount of your Tax Forgiveness. Claimants of all unemployment programs offered during 2020 receive a 1099 tax form detailing their benefit payments.

Individuals with non-fraud overpayments do not need to be concerned about any of the threats on that notice and that is why it is so problematic said Julia Simon-Mishel an. UCMS provides employers with an online platform to view andor perform the following. Compare the Top Tax Forgiveness and Find the One Thats Best for You.

Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability. Provides a reduction in tax. In 2020 the Covid-19 pandemic led the US.

Report the 25000 the total amount of your unemployment compensation on line 7 and report 15200 on line 8 as a negative amount in parentheses. Ad PA residents who save in PA ABLE get benefits that other states ABLE plans cant provide. Report unemployment income to the IRS.

If you live in PA and open a non-PA ABLE account you may miss out on important benefits. While taxes had been waived on up to 10200 received in unemployment for those making less than 150000 in 2020 -- the first year of the pandemic -- that was only temporary. Up to 25 cash back That amount known as the taxable wage base currently is set to increase by 250 per year in Pennsylvania at least until 2018.

Unemployment and pension payments. We Help You Pay the Lowest Tax Amount Allowed By Law. Businesses can file and pay quarterly PA Unemployment Compensation UC tax through the Pennsylvania Department of Labor and.

Unemployment Compensation UC Taxes. To claim this credit it is necessary that a taxpayer file a PA.

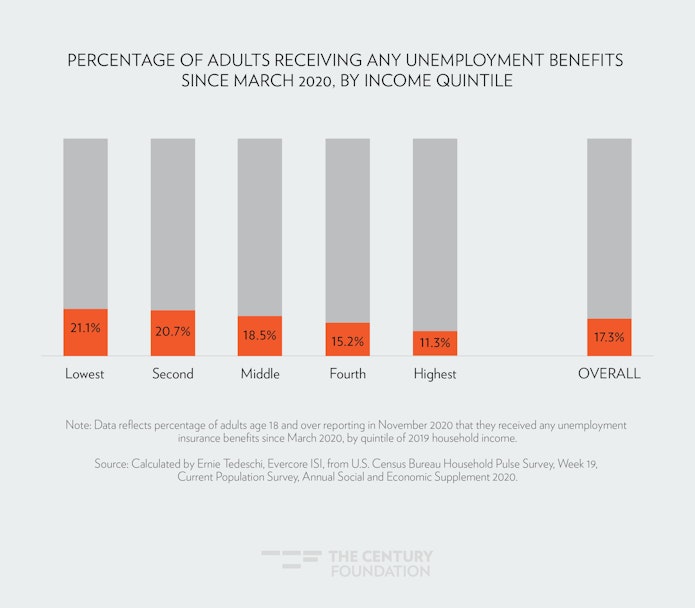

The Case For Forgiving Taxes On Pandemic Unemployment Aid

Covid Bill Waives Taxes On 20 400 Of Unemployment Pay For Couples

Felder Demands Tax Relief Again Ny State Senate

How Unemployment Benefits Can Affect Your 2020 Taxes

Don T Forget To Pay Income Tax On Your Unemployment Benefits Omni Tax Help

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

The Case For Forgiving Taxes On Pandemic Unemployment Aid

Another Blow To Working People During The Pandemic States Snatching Back Tax Refunds Center For Public Integrity

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

D C Council Considers Tax Relief For Residents Getting Unemployment Aid Npr

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Pennsylvania S Path To Tax Relief Commonwealth Foundation

Unemployment Recipients May Want To Wait To File Their 2020 Tax Returns

Stimulus Payments Start To Arrive The Latest On The Coronavirus Relief Bill The New York Times